Licensed Money Lenders

With very little statistical information on moneylending firms, it is critical to note that this industry which generally services the needs of low-income individuals, is exceptionally heterogeneous and borrowers should approach them with caution.

The advantage of borrowing from licensed moneylenders in Singapore is that they are regulated by the Ministry of Law and if you borrow money from these companies, there is a cap on how much interest they can charge, and what they can charge in penalties if you’re late in repaying. However, working with a strongly heterogeneous group of firms clearly creates significant challenges for any government trying to regulate an industry and hence, it is still common for licensed moneylenders to engage in unsavoury business practices.

Even with the interest rate cap in place, unique lending models have been created by them in an attempt to work around the negative impact of the interest rate cap. More often than not where a borrower misses a payment, new loans are being sought from other moneylenders to avoid being subject to significant late payment fees from the first lender. From there, the initial amount quickly snowballed to an unmanageable size owing to multiple lenders.

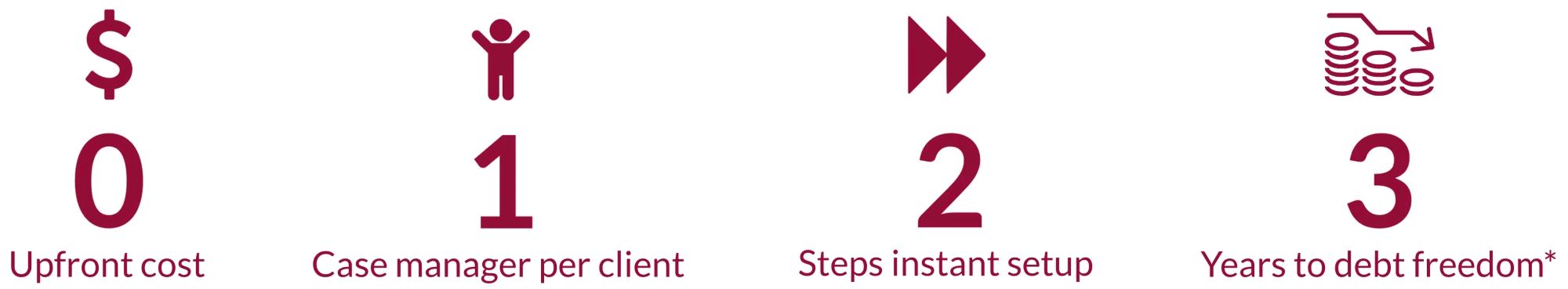

Are you in a cycle of debt with 1 or more licensed money lenders or a subject to their harassment at your home or workplace? Know your rights and solutions to your LML debts at our private Debt Relief session for free.